GEM Data: The Independent IPV Marketplace for OTC Derivatives

GEM Data is the Neutral Data Utility built by the industry, for the industry. We operate as an independent, secure third-party platform dedicated to improving the efficiency and governance of data consumption within the financial sector.

Learn More Transforming

How Institutional Data Flows

GEM Data is a fintech startup building a next-generation data brokerage platform.

We streamline how investment banks interact with data—making the distribution, aggregation, and monetization of information more efficient. Our platform enables secure, scalable data delivery for banks, hedge funds, asset managers, and other institutional participants.

Explore Our PlatformA Smarter Way

to Move Financial Data

Driving Competition and

Innovation in IPV

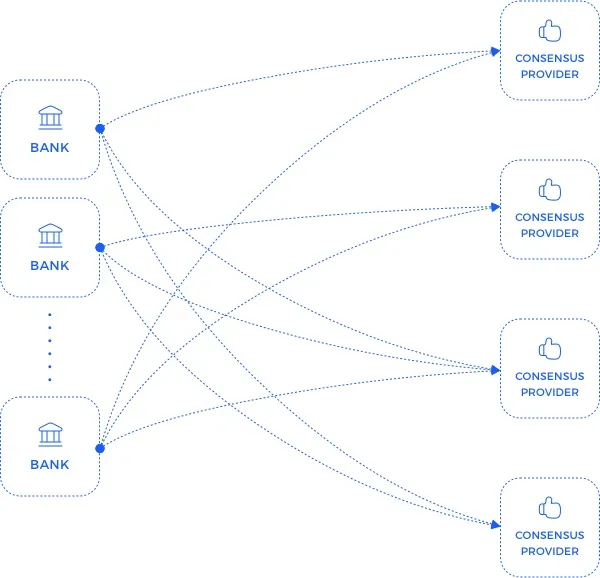

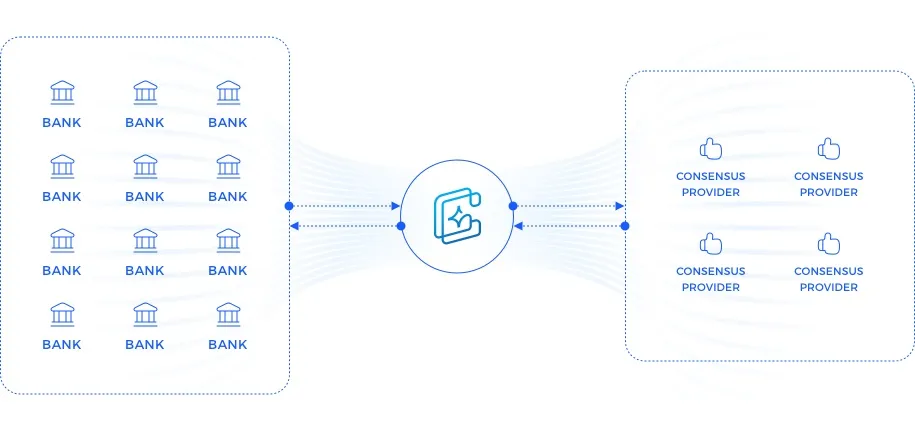

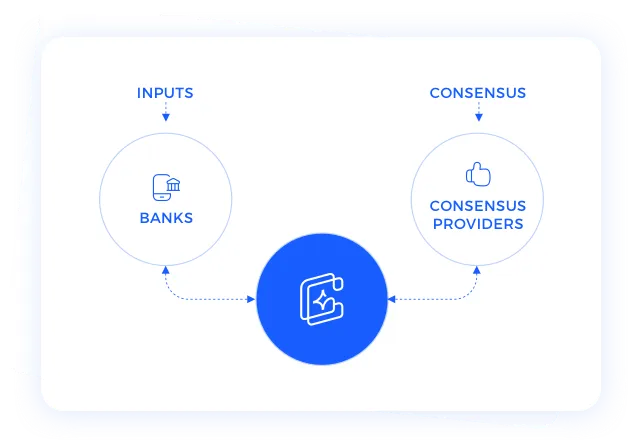

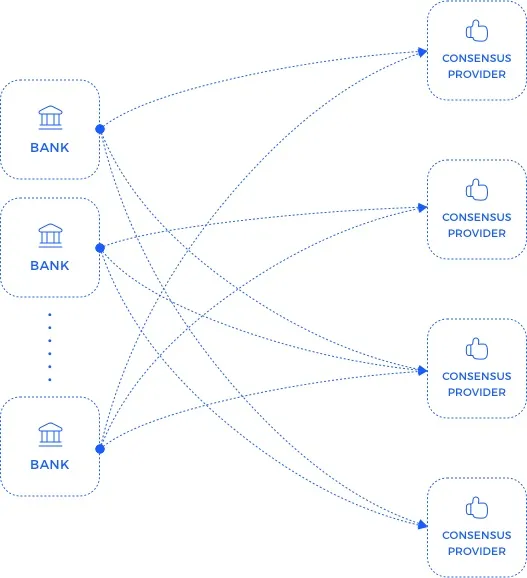

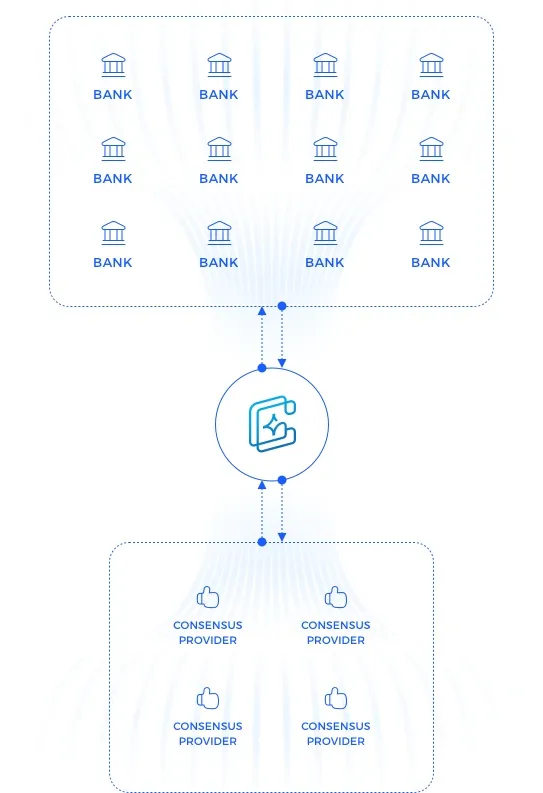

GEM Data transforms the current, inefficient bilateral data exchange model into a centralized, competitive marketplace. Our core activity is to empower contributing banks to access superior Independent Price Verification (IPV) services efficiently and affordably by leveraging OTC derivative data on all major asset classes.

Data Focus: Comprehensive OTC Derivative Coverage

We specialize in the secure custody and standardization of your OTC derivative data, covering FX, Equities, Rates, Credit, and Fixed Income. Our platform ensures this complex data is ready for compliant consumption by leading IPVs.

Seamlessly transition your entire OTC derivative valuation process to a single, standardized platform, guaranteeing consistent data quality and coverage across all asset classes for accurate IPV.

The IPV Marketplace: Increase Competition, Reduce Cost

Secure environment where your standardized OTC derivative data can be presented to multiple Independent Price Vendors (IPVs). By pooling data and standardizing the access mechanism, we force IPVs to compete on price, innovation, and service quality.

Maximize competition among IPVs, leading directly to reduced service costs and access to a broader range of specialized, innovative IPV services tailored for complex derivatives.

Efficient & Secure Data Contribution (Client-First Model)

We provide a secure, standardized pipeline for banks to contribute necessary data once. Our platform handles the complexity of data alignment, anonymization, and governance on your behalf.

Dramatically reduce operational overhead and time-to-market associated with setting up and maintaining multiple, complex data feeds and contractual relationships.

Controlled & Compliant Governance

GEM Data acts as the independent data custodian. All data transactions are recorded for comprehensive audit and regulatory purposes (e.g., GDPR, CCPA).

Achieve peace of mind that sensitive OTC derivative data usage is fully compliant and transparent, drastically reducing regulatory and operational risk.

Our Credibility: Backed by Global Banks,

Built for Industry Trust

Neutrality

We are not an IPV provider or a bank — we are the independent market infrastructure enabling a level playing field for all participants. Our neutral position ensures that contributing banks and IPV vendors operate in a fair, unbiased, and transparent environment, free from competitive conflicts of interest.

ExploreSecurity & Compliance

Our platform is engineered to meet the highest standards of data custody, privacy, and regulatory compliance. Mandated by our founding bank members, GEM Data incorporates robust controls to support GDPR, CCPA, and other global regulatory requirements, ensuring that every data exchange is secure, auditable, and properly governed.

ExploreScale

The scale of our backing provides the critical mass required to standardize OTC derivative data contribution across the industry. By aggregating participation from leading global banks, we enable meaningful competition among IPV providers and deliver cost efficiencies, data consistency, and improved market transparency.

ExploreAsset Classes We Support

Equities

Deep coverage of OTC equity derivatives ranging from flow Vanillas to complex Exotics. Our dataset supports Cliquets, Autocallables (Phoenix, Reverse Convertibles), Variance & Volatility Swaps, and Range Accruals. We also cover Path-Dependent and Multi-Asset structures, including Barriers (Knock-in/out), Asians, Lookbacks, Ladders, Baskets, and Best-of/Worst-of options.

ExploreFixed Income

Extensive coverage of OTC interest rate and credit derivatives. Data sets include Interest Rate Swaps (IRS), Swaptions (European & Bermudan), Caps & Floors, Inflation Swaps, and Credit Default Swaps (CDS).

ExploreFX & Currencies

Dedicated data for OTC foreign exchange derivatives. Support includes Vanilla FX Options, Non-Deliverable Forwards (NDFs), Cross-Currency Swaps, and Exotic structures such as Barrier Options, Asians, and Touch/No-Touch contracts.

ExploreCommodities

Specialized pricing for OTC commodity derivatives across energy, metals, and agriculture. Coverage spans Commodity Swaps, Financial Forwards, and Exotic Options including Asian, Strip, and Spread structures.

Explore